Taking on your first employee is a huge milestone for you and your business. However, you need to think about a lot of different things when you become an employer. Among other responsibilities, you'll have to comply with local tax legislation, employment law and report to LHDN on how much you pay your employee and deduct from their salary. In this guide, we will outline the essential procedures you'll need as a new employer to ensure a smooth transition into employerhood.

1. Employees Provident Fund (EPF)

Every employer must register with the EPF within 7 days from when they first hire an employee. To become a registered private-sector employer (SSM registered), here are the documents you need:-

- Form KWSP 1

- Form 49/Superform (acquire from SSM)

- Copy of the sole proprietor/partner/director's identification (MyKad/Passport)

- Certification of Company/Business Registration (acquire from SSM)

Alternatively, you can also prepare the documents below:

- Section 15 - Notice of Registration

- Section 14 - Application For Registration Of A Company

- Section 17 - Certificate Of Incorporation Of Private Company

Once you have acquired all the documents listed above, kindly proceed to any EPF counter to register. Upon successful registration, the employer will receive:-

- Employer's Reference Number

- Notice of employer registration

- Employer's Registration Certificate (to be displayed at employers' premises)

Tip 1: An employer can apply to be registered under more than one employer's reference number to facilitate the monthly contribution payments.

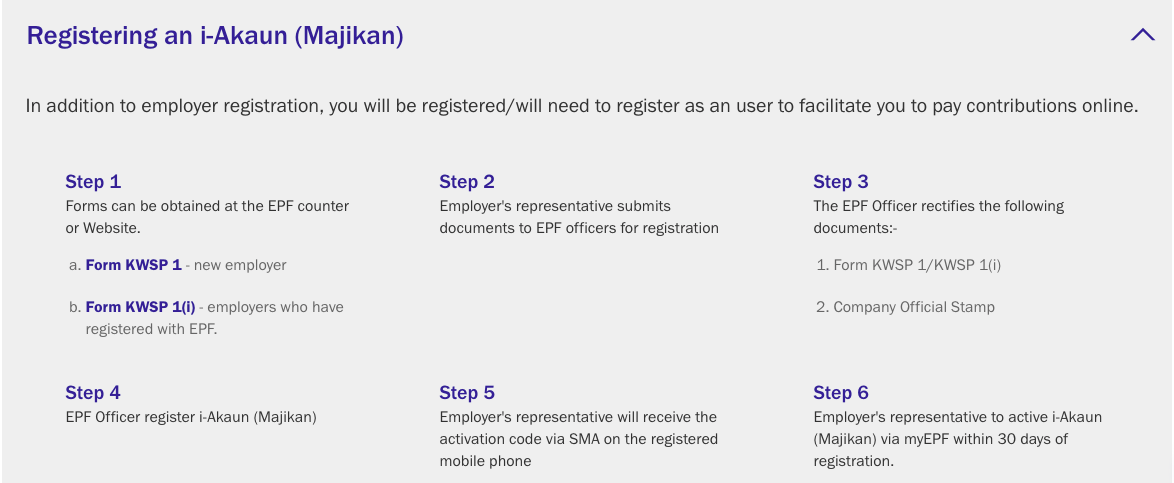

Tip 2: In addition to employer registration, you will be registered/will need to register as a user to facilitate you to pay contributions online.

Did you know that you're able to generate EPF file via Swingvy Payroll Software?

Once you had finalised the monthly payroll, the EPF text file can be generated from the system and upload into KWSP eCaruman directly. Learn more about Swingvy Payroll Software.

2. SOCSO

New employer must be registered with SOCSO within 30 days upon hiring a new employee. For registration purposes, an employer is required to complete the Employer's Registration Form (Form 1) alongside other supporting documents via the ASSIST Portal.

- Employer's Registration Form (Form 1)

- Employee's Registration Form (Form 2)

- Other Supporting Document according to your company type

To access the ASSIST Portal, users must fill up the Borang Permohonan Enrolment Penggunaan Portal Assist and email the completed form to idportal@perkeso.gov.my.

Additionally, any employer who ceases to be an employer is required to inform SOCSO by uploading a completed Form 1A together with the relevant documents within 30 days from cessation via ASSIST Portal.

How can I auto generate SOCSO form via Swingvy Payroll Software?

After the payroll confirmation, SOCSO 8A test file will be made available to download under SOCSO column. It can be uploaded into SOCSO Assist Portal for submission and payment. Read more here.

3. Employment Insurance System (EIS)

PERKESO introduced Employment Insurance System (EIS) in January 2018. To provide a helping hand to employees who have lost their jobs due to retrenchment or various circumstances for up to six months.

Employers who have not registered with EIS can do so via the ASSIST portal. If you yet have an account with ASSIST, users must fill up the Borang Permohonan Enrolment Penggunaan Portal Assist and email it to idportal@perkeso.gov.my.

Refer to this table if you would like to know more about the EIS contribution rate.

Tip 1: Employees are only considered insured on the day their employer registers with SOCSO. Employers will be held liable and may be prosecuted if they do not carry out this responsibility.

4. LHDN (PCB)

E-Daftar is an online application by LHDN made available for new employers to register their tax files and receive their tax reference number. Employers able to obtain their E number upon completion. To do so, users must fill up this form available on LHDN official website.

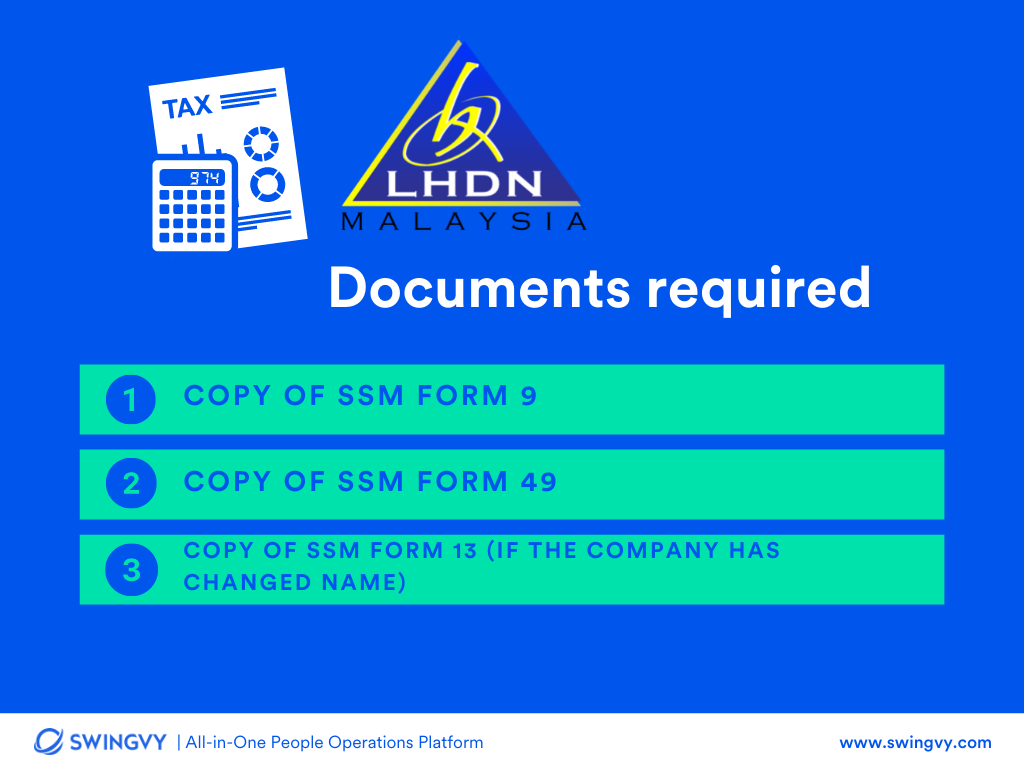

Upon completing the form, employers are required to key in their application number under this website to check application status, upload required documents stated below and print registration details upon successful registration.

- Copy of SSM Form 9

- Copy of SSM Form 49

- Copy of SSM Form 13 (if the company has changed name)

Tip 1: Do note that e-Daftar applications will be cancelled if complete documents are not received within 14 days from the date of application.

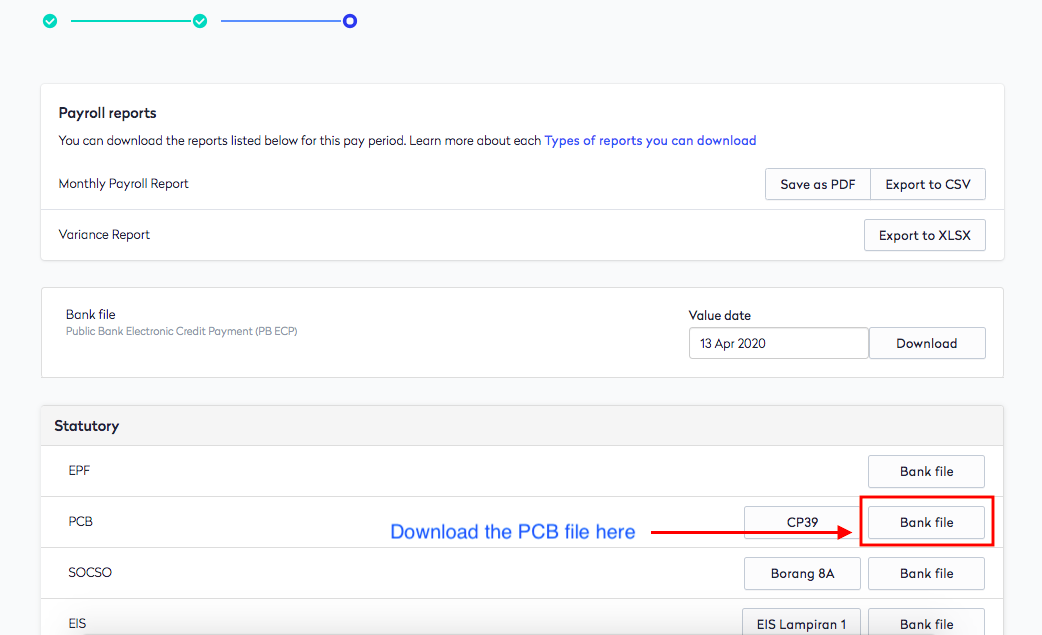

Can I auto generate PCB file via Swingvy Payroll Software?

Once you processed your payroll via Swingvy payroll, PCB text file will be ready for your download and can be uploaded via LHDN e-Data. Learn more about Swingvy Payroll Software.

Not a Swingvy user?

Learn more about Swingvy's payroll and compliance software and get the support you need to run your business with confidence.

.png)