Employer's tax obligations such as filing of Form E and preparation of employee's Form EA would be at the company's agenda during the first quarter of every year. If you are new to filing taxes for your company, let us break it down for you.

----------------------

What does a Malaysian employer need to prepare for tax season?

- Filing of Return Form of Employer (Form E) with CP8D Form

- Preparation of employee’s Statement of Remuneration from Employment (Form EA)

Now that you know what to prepare, get your calendar ready (Google Calendar, Microsoft Outlook Calendar, physical calendar etc) and block out 31st March every year to remind yourself on tax filing deadline so you won't miss it!

Even better, you can just save this google calendar reminder we created to notify you when tax filing deadline is near!

----------------------

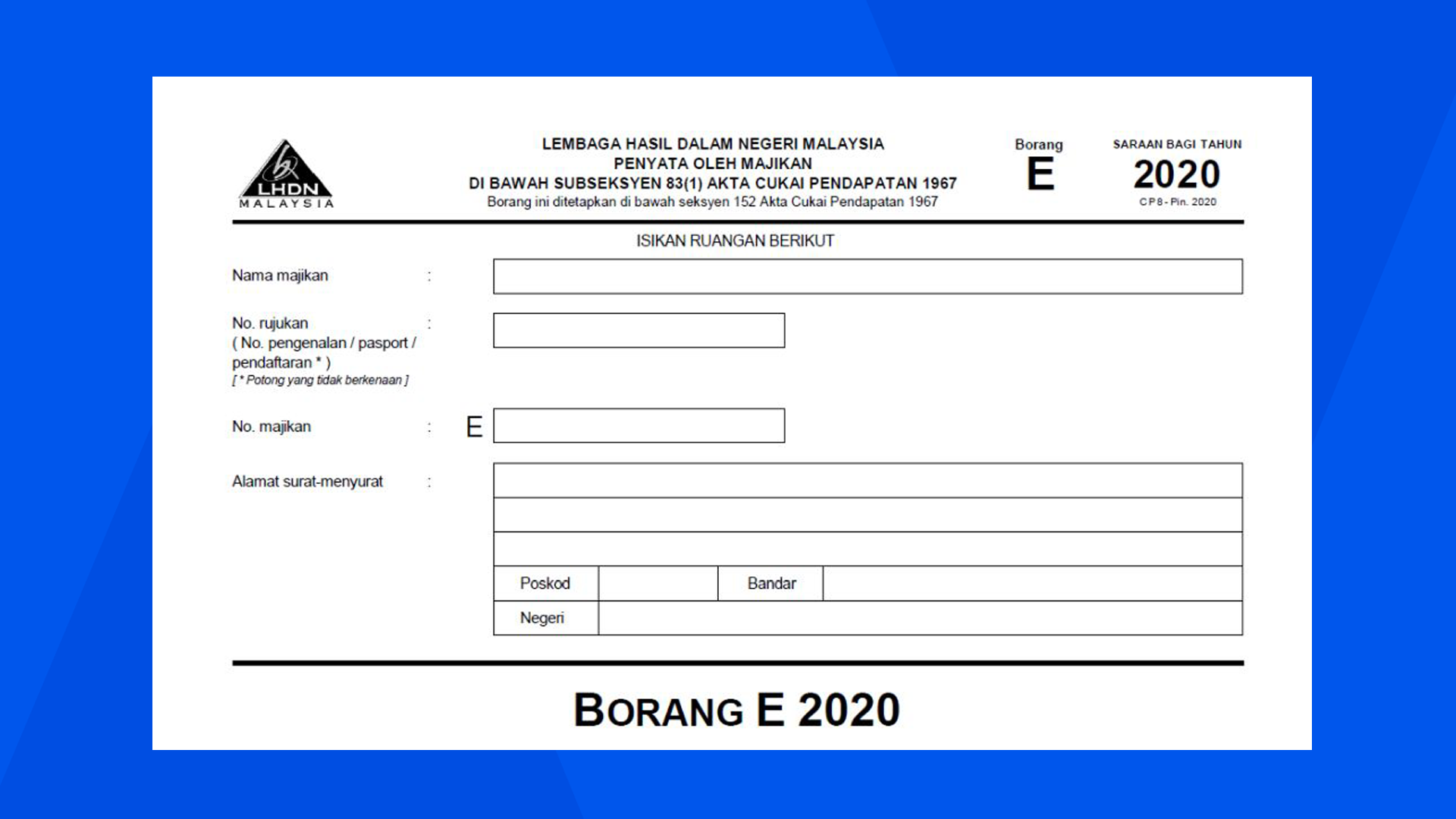

What is Form E?

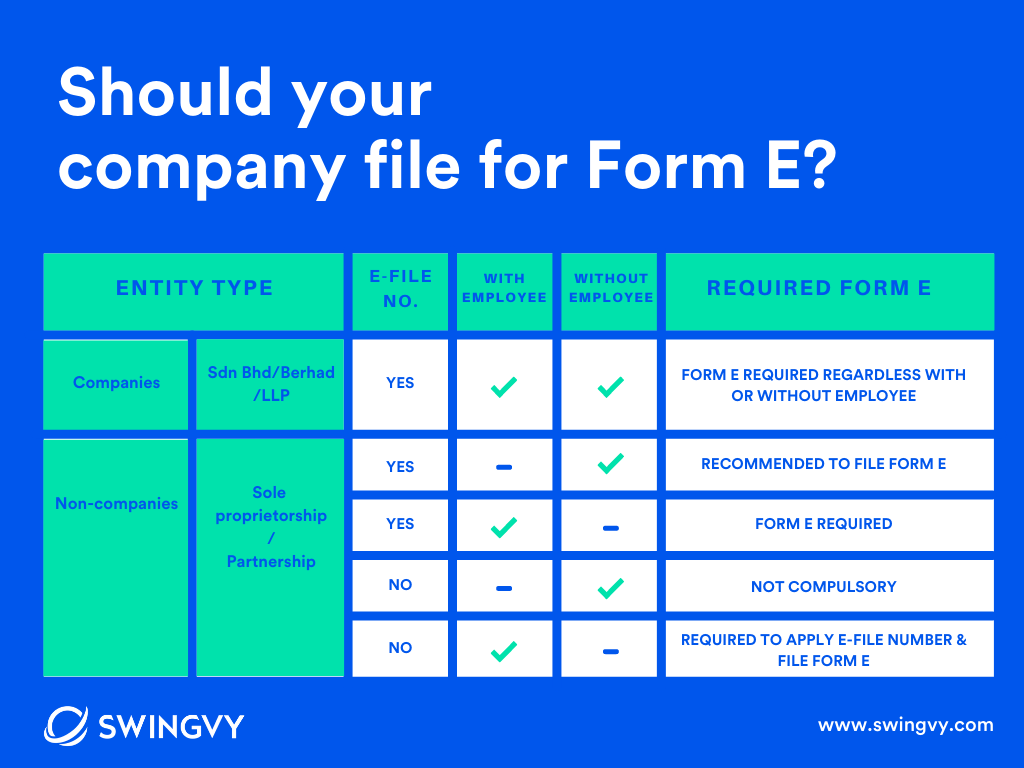

Form E is a declaration report required to be submitted by every employer (company/enterprise/partnership) to LHDN (Inland Revenue Board, IRB) every year not later than 31 March.

The following information are required to fill up the Form E:

- Employer’s (company’s) details

- Employees remuneration information(i.e. salaries, wages, allowance, incentives & etc.) to be included in the CP8D form.

Important things to take note about filing Form E:

- IRB no longer accepts manual forms.

- All MTD/ PCB calculation have to be done online using PCB calculator, payroll system, or LHDN’s own e-PCB system.

- Failure to submit Form E are liable to a fine of not less than RM200 and not more than RM20,000 or to imprisonment for a term not exceeding 6 months or to both under the Income Tax Act Section 120(1)(b).

How to generate Form E in Swingvy:

Generating Form E in Swingvy is easy - watch the video below to see how simple it is! In Swingvy payroll software, we provide two types of Form E according to the payment method where you can choose either E-Filling if you pay via online or manual filling for manual payment at LHDN counter.

For Swingvy users: Both Form E and Form EA for year of assessment 2020 are now available to generate and distribute to your employees within the Swingvy platform. Read more here.

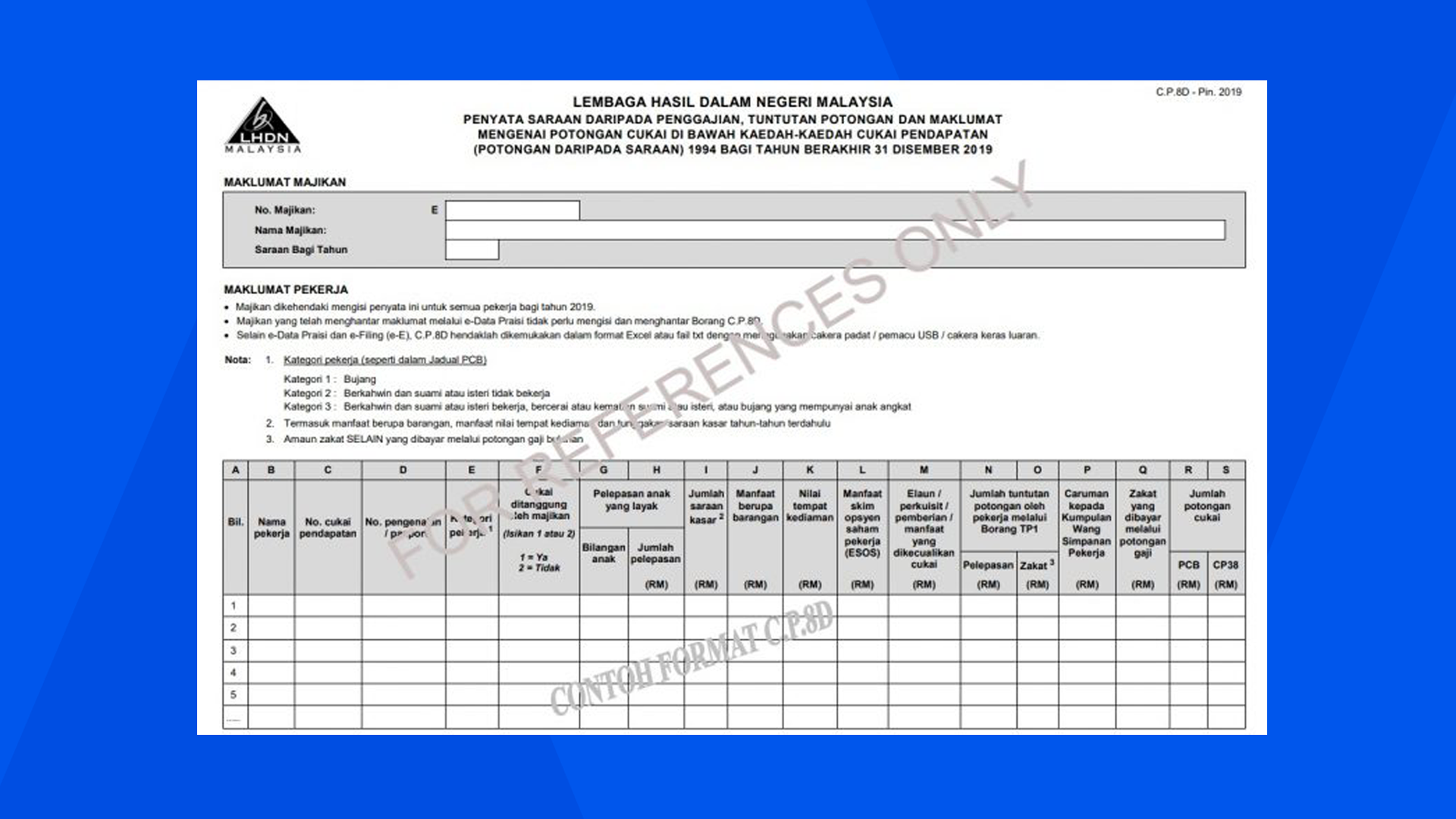

What is Form CP8D?

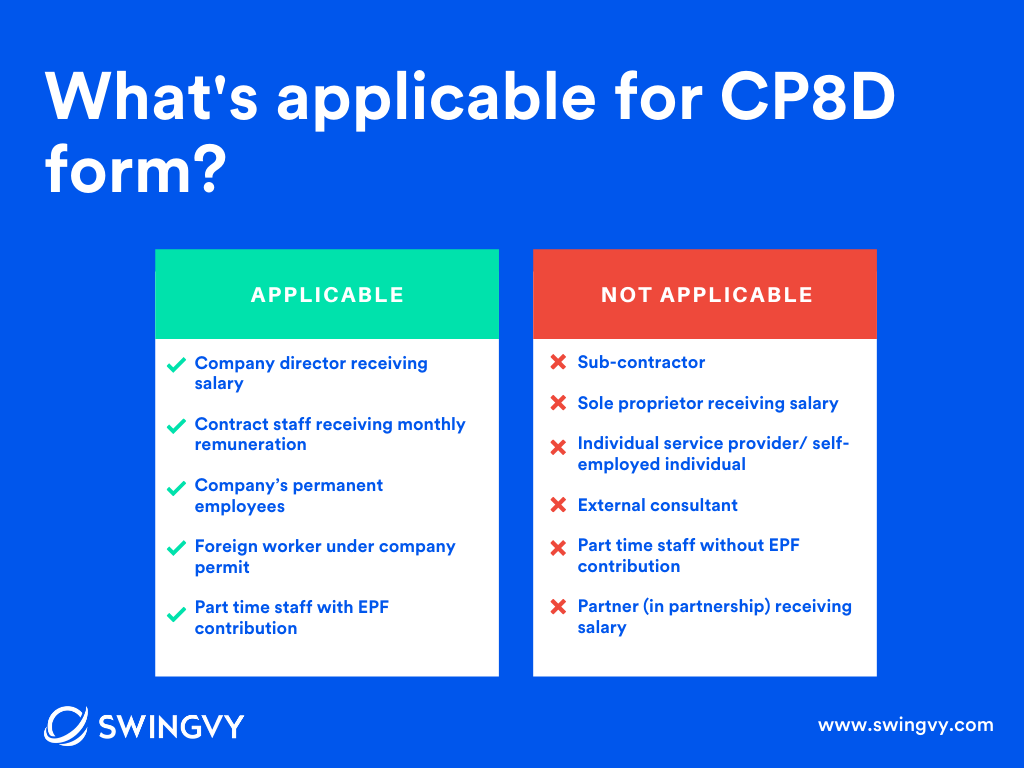

CP8D form refers to the return of remuneration by an employer, claim for deduction and particulars of tax deduction under the income tax rules (deduction from remuneration) 1994 for the year.

Remember that Form E will only be considered complete if CP8D is submitted on or before the due date for submission of the form. With the MCO 2.0 situation right now, we suspect there will be an extension for the deadline but we strongly encourage employers to always submit the form early i.e. before March 31 of every year.

Important things to take note about CP8D Form:

- Employers are required to complete the form in Excel or txt file format on all their respective employees for the previous year.

- Employers who have submitted information via e-Data Praisi need not complete and furnish Form C.P.8D.

- Other than e-Data Praisi and e-Filing (e-E), C.P.8D must be submitted in Excel or txt file format by sending an e-mail to CP8D@hasil.gov.my.

How to generate CP8D Form:

- Employers with their own computerised system can prepare C.P.8D data in the form of txt as per format specified.

- LHDN has prepared the C.P.8D format in Microsoft Excel 2003 to assist employers in preparing the data. Download file here: www.lampiran.hasil.excel/2013.com

If you are unclear about CP8D form, you may refer to the updated guide created by LHDN below:

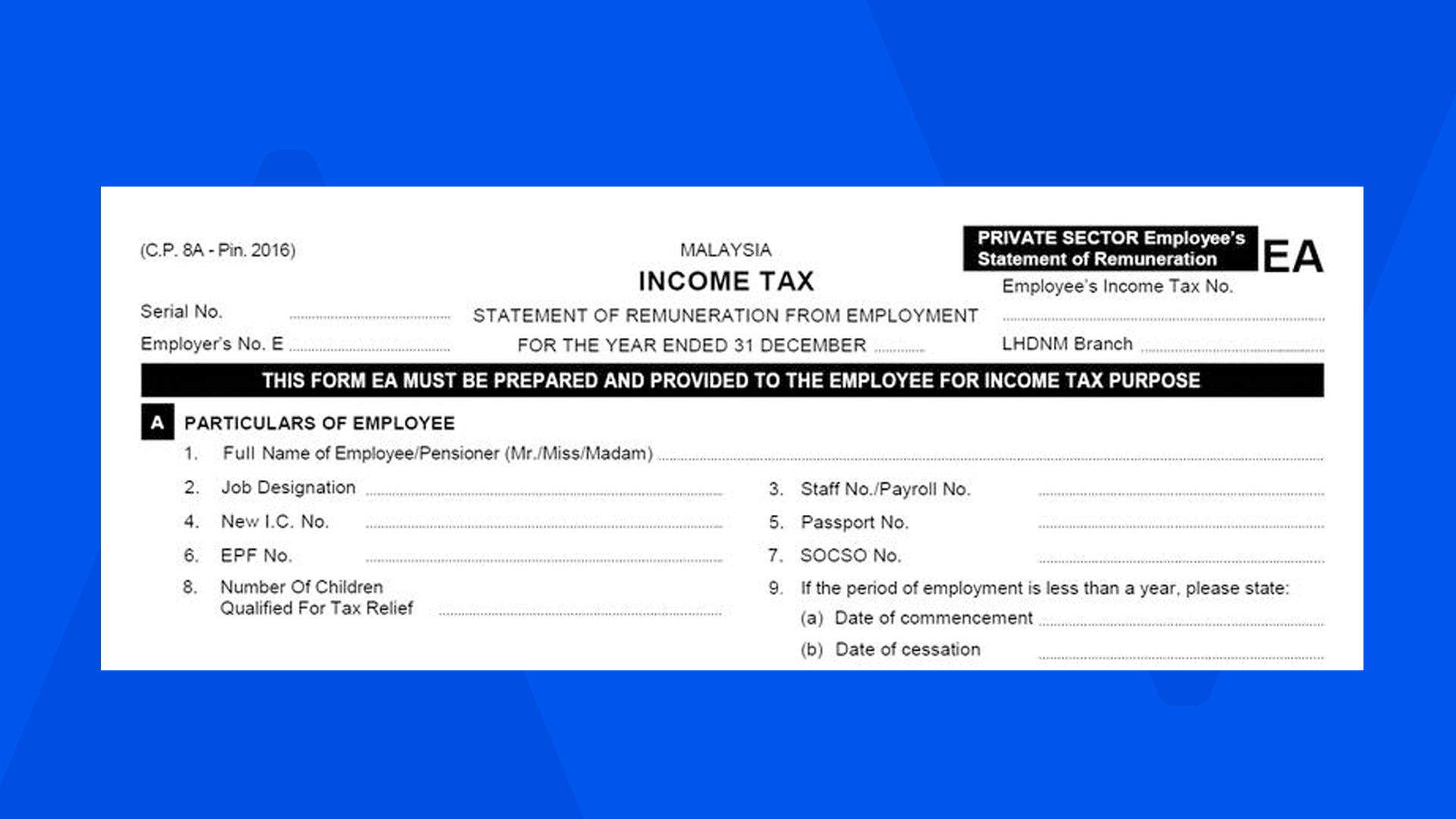

What is Form EA?

Form EA refers to Borang EA, EA Statement, EA Employee is an Annual Remuneration Statement that every employer shall prepare and disseminate to their employees before end of February every year.

According to Section 83(1A) Income Tax Act 1967, “that every employer shall, for each year, prepare and render to his employee statement of remuneration of that employee on or before the last day of February in the year immediately following the first mentioned year”.

Important things to take note about Form EA:

- Failure to prepare and render EA Form to employees before last day of February will be fined RM200 - RM20,000 or imprisonment for a term not exceeding 6 months or both.

- According to Malaysia Budget 2021, income tax exemption limit for compensation for loss of employment will increase from RM10,000 to RM20,000 for each full year of service applicable for YA (years of assessment) in 2020 and 2021.

How to generate Form EA in Swingvy:

Generating Form EA in Swingvy takes a few clicks to get it out to your employees. In Swingvy payroll software, you can choose either to send an email to your employees or download your employee EA form to print out hard copy. Watch the video below for a quick guided walkthrough to get your Form EA in less than a minute!

For Swingvy users: Both Form E and Form EA for year of assessment 2020 are now available to generate and distribute to your employees within the Swingvy platform. Read more here.

Bonus Tip: Team Up with a Payroll Tax Solution

Managing payroll while keeping compliant with Malaysian statutory regulations is the ultimate juggling act. But you don’t have to go it alone. Swingvy payroll software provides all the tools and support to easily run payroll while helping you file your payroll taxes and stay on top of employment-related tax compliance.

Why Swingvy Payroll Software?

- Certified and approved by LHDN, KWSP, PERKESO and HRDF

- Automatically calculates EPF, SOCSO, EIS, HRDF and PCB contributions into payroll.

- Flexible payroll amendment with unlimited payrolls.

- Access anytime to previous payslips, form E, form EA and employee payment details.

---------------------

Not a Swingvy customer?

Learn more about Swingvy payroll and get the support you need to run your business with confidence.

.png)